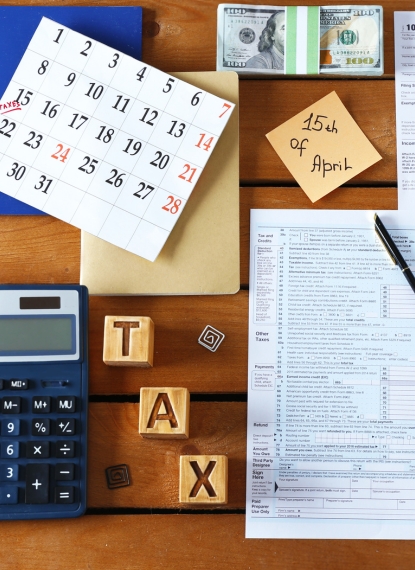

Individual Accounting

At Anderson & Associates CPA, we provide tax services for high-net-worth individuals who carry significant responsibility at work and at home.

Ideal for business owners, founders, executives, or board leaders, our services bring your financial fortitude full circle by ensuring your business, nonprofit, and personal finances flow in the same direction rather than work at crosscurrents from each other.

We know you often need more than a once-a-year tax filing. We offer year-round tax planning, proactive reviews, and clear guidance that connects your organizational role with your personal financial goals.

Our team brings calm and plain-English insight to complex situations because we understand the pressure that comes with protecting significant income and assets. The level of service we provide supports long-term financial stewardship, regulatory compliance, and sustainable growth.

Our Expertise in

Personal Accounting for High Net-Worth Individuals

Life at your level of responsibility rarely fits into tidy financial boxes. Income can come from multiple entities, equity awards, investments, and real estate. Family roles evolve, philanthropic commitments grow, and major decisions about housing, retirement, and legacy all carry significant tax and cash flow implications in the background. Our personal accounting services for high-net-worth individuals bring those moving pieces into one clear, thoughtful view of your financial life. This section highlights the key ways we help you interpret your numbers, anticipate what is coming next, and make choices that support both your current lifestyle and your long-term wealth and legacy goals.

For high-net-worth individuals, life moves through distinct seasons, and your tax strategy should move with it. Equity events, liquidity moments, career transitions, new investments, and evolving family priorities each carry tax implications that are too significant to address only at year’s end.

Our tax planning services for individuals keep planning in motion throughout the year, so changes in income, assets, family, or work receive timely, thoughtful attention. You gain a rhythm of structured check-ins that connect your goals to specific actions, from estimated payments and retirement funding to charitable strategies and the timing of major financial decisions. Each conversation builds on the last and supports both your current lifestyle and your long-term security and legacy.

What this looks like in practice:

-

- Regular touchpoints to review changes in income, liquidity events, expenses, and goals.

- Updated tax estimates and recommendations as your situation evolves across entities and jurisdictions.

- Clear guidance on retirement contributions, savings targets, charitable giving, and strategic timing of significant transactions.

- A living tax plan that grows with you, rather than a one-time projection that quickly goes out of date

Want a tax plan that adapts as quickly as your life does?

Book a Financial Strategy Session.

Tax season feels very different when complex finances are organized in advance and explained with clarity. When you have multiple income streams, equity compensation, investments, real estate, and charitable activities, you need tax services that bring everything together into a coherent picture.

With our personal accounting services, your income, deductions, and credits are gathered and reviewed through a calm, structured process. You see how each element fits together, why your tax return looks the way it does, and what the results mean for the year ahead in terms of cash flow, planning opportunities, and potential risks.

Every filing becomes a clear snapshot of your financial story, prepared from accurate data and presented in language that respects your expertise and time.

What this looks like in practice:

-

- Thoughtful intake that captures all sources of income, entities, equity awards, investments, and key life events.

- Organized support for gathering tax documents and keeping them in one secure, central location.

- I have prepared from reconciled, accurate data and reviewed with you line by line, with attention to material items.

- Practical guidance on what the final numbers mean for your near-term plans, long-term wealth strategy, and future tax positioning

Ready for tax returns that feel clear, disciplined, and reassuring?

You can book a Financial Strategy Session.

Our high-net-worth individuals, major life events carry significant financial and tax consequences. New executive roles, liquidity events, home purchases, marriages, children, business ventures, and relocations each raise planning questions that are best addressed before they occur rather than after.

Our tax planning services for high-net-worth individuals give you a dedicated place to bring those milestones and evaluate the financial impact with clarity. Together, we look at how changes in salary, equity compensation, location, or family structure interact with your broader balance sheet and long-term objectives, then identify specific steps that keep you grounded, prepared, and aligned with your overall strategy.

What this looks like in practice:

-

- Guidance around job transitions, bonuses, equity grants, vesting schedules, and liquidity events.

- Thoughtful conversations about buying or selling a primary residence or second home, and how each decision fits into your overall plan.

- Support for shifts in family structure, including marriage, children, divorce, or caregiving responsibilities.

- Planning for moves across state lines, remote work arrangements, or multi-state and international income

Planning a significant change and want financial clarity?

Book a Financial Strategy Session.

Our Services for

Individual Accounting

Our individual financial analysis services, including IRS representation services, are designed to provide you with insightful perspectives. We help you make informed decisions, identify opportunities, and optimize your financial strategies for sustainable growth. At Anderson & Associates CPA Inc., we elevate you beyond just navigating finances; our experts will assist you in maximizing opportunities for success.

Annual Tax Preparation

Your return reflects the story of your year. We organize income, deductions, credits, and special circumstances into a clean, accurate filing that honors that story. You receive returns prepared with care, reviewed with you in plain language, and filed on time so you can move forward with a sense of completion and clarity.

Ongoing Tax Planning

Income changes, family situations evolve, and new opportunities appear throughout the year. Ongoing tax planning keeps your strategy aligned with those shifts. We check in on changes in income, investments, and goals, then adjust your plan so each decision supports a lighter tax burden and a healthier long-term picture.

KNOW BEFORE YOU START

Frequently Asked Questions

We know accounting services can raise a lot of questions. Below are answers to the most common ones, so you can quickly understand our process, approach, and how we support you.

What is a financial strategy session?

A free 30-minute virtual session to discuss your goals, introduce the firm and establish how we can support your organization.

Can you work with our existing bookkeeper or finance staff?

Yes. We often partner with internal staff who already understand your programs and day-to-day operations. We provide CPA-level review, nonprofit accounting structure, and financial strategy so your team has support, and your board gets the clarity it’s been asking for.

Our books are behind, and a bit messy-should we wait until things are cleaned up?

Most leaders come to us feeling some version of “I’m embarrassed by our books.” That’s when outside support is most useful. Our clean-up services will help you move from behind and overwhelmed to caught up and audit-ready. Our ongoing services are mission focused, designed to maintain the structure we create in a clear-up, help you stay on top of your finances, make informed decisions, and drive long-term success.

Are your nonprofit accounting services only for larger organizations?

We primarily serve small to mid-sized nonprofits organisations. During a financial strategy session, we’ll look at your size, funding mix, and goals, and recommend only the level of support that makes sense for where you are now.

What’s the next step if we’re interested?

The best next step is a free financial strategy session. This is an open session to talk through your pressures and priorities, get to understand how our firm operates then determine if we are a good fit.

Get Inspire

Client Testimonials

Let’s review your current setup, talk through your goals, and outline practical next steps.

Tara Robinson

When you grow leaps and bounds, you need someone who can carry you through. When you are so anxious around numbers, you need reassurance. When you want someone to handle it all, you can depend on read more

02 Dec, 2025

Lyndsay Levingston

A&A CPA has helped our organization to organize our financials and get us on a positive track. Great, comprehensive attention to detail and follow-through to ensure all deliverables and tasks are accomplished.

07 Oct, 2024

Dyna Nelson

My non-profit used Anderson and Associates for our business start up and the application for non-profit designation, 501(c)(3). I have heard how hard that is and how some people have to resubmit several times but read more

07 Oct, 2024

Schedule a Financial Strategy Session

Let’s find opportunities to optimize your operation and support what’s already working.